Hi there!

Welcome to

Verdana Partnership

Through

Synergy

&

Sustainable

Wealth

Personalized Investment Advisory that focuses on generating the most optimum long-term return for clients compared to other investment instruments with measured risk.

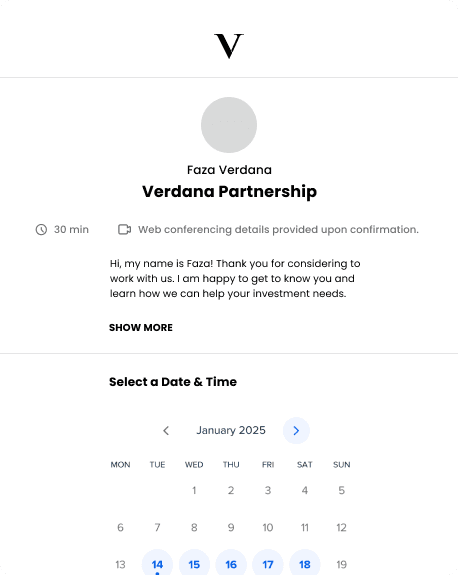

Before getting started, let's take a moment to connect. We'd like to schedule a short Google Meet session with you. It's a great way for us to introduce ourselves, answer any questions you might have, and ensure that our service aligns perfectly with your needs.

Looking forward to chatting with you soon!

Btw, you can take a moment to explore our prospectus here. It’s a great way to get familiar with what we offer and how we work. This will help us have a more productive and focused conversation. Can’t wait to connect with you soon—see you on the call!

For many, investing can feel difficult.

You might find yourself wondering...

“I don’t know where to invest my money.”

You have some savings sitting idle, but you’re unsure where to start. You haven’t had the chance to learn about investing and don’t want to make the wrong choice.

“What if it’s not safe?”

You’ve heard about scams and bad investments. Even mutual funds have been underperforming lately, and you’re worried about losing money.

“Can I really reach my financial goals?”

You want to grow your wealth and achieve your dreams, but only with investment tools that are secure and trustworthy.

Sit back & relax.

Watch your funds grow

Since Jun 30, 2020

Chart Updated Daily, Reksadana Data from Bareksa. Past performance does not guarantee future performance. Recompound is an

information provider and never guarantees returns.

Chart Updated Daily, Reksadana Data from Bareksa. Past performance does not guarantee future performance. Recompound is an information provider and never guarantees returns.

Verdana Partnership is similar to other “Reksadana Saham” available on platforms such as Bibit and Bareksa.

But here’s what makes us different

Your funds stay safely with you; we do not keep your money, so we cannot run away with it.

Fees are only charged based on your portfolio growth (0% management fees).

The fee structure allocates 70% to clients and 30% to Verdana Partnership.

We offer superior potential returns compared to traditional “Reksadana Saham”.

FAQs

Is There a Minimum Initial Investment?

We require all new customers to agree to commit a minimum of IDR 200 million (200 juta Rupiah) to start using Verdana Partnership’s services. This is to ensure they are committed to us for the long term and not abusing our hard work.

Can You Guarantee My Portfolio to be Profitable Below 1 Year?

Absolutely not. This is because our investment instrument is stocks, a vehicle for long term wealth accumulation, which have volatility embedded in the short term. In the short term, price can fluctuate wherever it wants. However, over the long run, stock prices will eventually follow the company fundamentals. If your fund is unused longer than 1 year, we are highly confident your portfolio will grow. If you expect returns below 1 year, investing in stocks is not for you. You may consider other asset classes such as bonds / money markets. If there is anyone offering you guaranteed returns higher than the risk free rate (i.e. government bonds), you should run away ASAP!

What is Verdana’s Investment Framework?

We use value-based approach when we generate our investment ideas. We will not attempt to predict future market movements, whether they will go up or down, because that is not important. What we consistently do is search for and identify undervalued stocks, both in the category of work-outs and general investments. Let we explain what ‘work outs’ are. Work out stocks are those whose value and price fluctuations depend more on specific corporate actions taken by the company rather than market fluctuations. These work outs can include actions such as sales, mergers, liquidations, tenders, and others. The risk of investing in such stocks lies in the possibility of the corporate action being canceled or failing, but there is less risk due to changes in the economy or a decline in the stock index. What we mean by ‘general’ stocks are regular stocks of companies that operate as usual, which we buy because they are undervalued. Stocks in this category are much more susceptible to market fluctuations, whether bullish or bearish, compared to stocks in the work-out category. Remember that just because a stock is undervalued (cheap) does not mean its price cannot drop when the stock index corrects. For the full year's performance, we would be satisfied if our portfolio achieved a performance 10% above the IHSG. Thus, it can be said that the past four years have been successful for Verdana Partnership, which was established in 2020. We have extensively attached our sample investment thesis in another article: https://bit.ly/VPThesis. We also provide our proof of transactions (from one of our clients) to demonstrate our conviction in our past thesis.